Leonardo CEO detailed Boost Capacity plan to deal with surging Defence spending

The Leonardo first semester 2025 results were only a part of the dedicated conference call, as the CEO Roberto Cingolani, focused also on the three joint ventures – LBA Systems with Baykar, LRMV with Rheinmetall and EdgeWing with BAE Systems and Japan Aircraft Industrial Enhancement Company – but more interestingly, he unveiled for the first time, “the methodology we’re developing for increasing capacity and efficiency into the company in view of the strong growth that we all expect because of the geopolitical situation”. He also provided details of the emerging acquisitions within the cyber security area, but more important ly about the Iveco Defence Vehicles (IDV) business from Iveco Group, “that has been finalized in the hours before the conference call”, and already reported by EDR On-Line, alongside the unveiling without details of the integrated air defence package developed by the company and just an update on the relaunching of the aerostructures business

Leonardo and International partnerships

“We’re really running fast,” Cingolani said about the LBA Systems JV. “Established in the second-half 2025, we already started the integration and production, and by the Q1/26 we expect to start the sale campaigns. In Ronchi dei Legionari, where we have our drone plant, we are not only developing a new programme within our Mirach legacy family of platforms, but we also have prepared the site to accommodate the final assembly line for the Baykar TB3 unmanned air system that will integrate all the payloads produced by Leonardo. In Turin, the team is ready to work on engineering and certification activities, which are mandatory because we want to export those platforms in Europe, and possibly outside. In Villanova d’Albenga close to Genoa [the site of Piaggio Aero Industries which was recently acquired by Baykar and where the JV legal HQs has its base, author’s note], we have set up the final assembly of the TB2 and Akinci platforms,” Cingolani explained.

In Rome, the Leonardo team has set up the multi-domain technologies innovation hub where it is preparing and integrating all the payloads to be installed on board the different unmanned air vehicles (UAVs), while in Grottaglie, currently devoted to aerostructures production, the JV is preparing the composite manufacturing and the final assembly site for the Kizilelma. “The latter is a very interesting product: it’s a drone jet fighter that could be the ’adjunct of choice‘ for us because it is very flexible thanks to its considerable payload, anticipating significantly our capabilities in this segment, also in view of the GCAP programme. LBA Systems is already part of our network and you will see the numbers over the next quarters.”

The Leonardo Rheinmetall Military Vehicle JV, “is up and running and the governance and top management is actually in place,” said Leonardo presenting the slide of the production plan for the Italian Army, including a total of 1,050 infantry fighting vehicles (IFV) for the AICS programme and 272 units for the MBT programme. This, added Leonardo CEO, does not includes by any means export potentialities “which hopefully and very reasonably will develop an extra demand.”

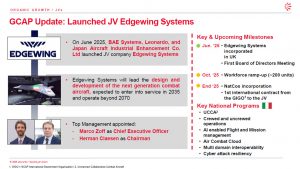

The third JV recently involving Leonardo is connected with the Global Combat Air Programme (GCAP) between Japan, UK and Italy. After the establishment of the GCAP International Government Organization (GIGO), “the EdgeWing Systems company was established in June 2025 including BAE Systems, Leonardo and the Japan Aircraft Industrial Enhancement Company (JAIEC). The company will lead the design, development and production of the first sixth generation combat aircraft expected to be available by 2035, and will operate at least up to 2070 with an (initial) top management centred on Marco Zoff, the former chief of the aircraft division in Leonardo and now the chief executive officer of EdgeWing, and Herman Claesen as the chairman.”

The JV is therefore up and running and by the end of 2025 it will have a workforce of approximately 200 units.” In the meantime, by the end of 2025 the national ramifications of the company in Italy, UK and Japan will be launched with joint activities dedicated to specific programmes working in parallel for the benefit of the programme, alongside the first international contract from the GIGO to the JV. According to the presented slides, Italy will focus mainly on the Unmanned Collaborative Combat Aircraft (UCCA), crewed and uncrewed operations, artificial intelligence flight and mission management, multi-domain interoperability, and cyber-attack resiliency.

“With the incorporation of these JVs – as these companies are up and running and aren’t considered any more inorganic – in the huge amount of activities Leonardo will develop over the next years, this will require a lot of effort to deliver both in terms of increased capacity in production and increased efficiency, and this very thin boundary between efficiency and capacity is exactly what we are targeting with the Capacity Boost programme.”

The Capacity Boost programme

Looking to the international scenario, Leonardo CEO highlighted how the recently approved NATO Defence Strategy is shaping and requesting a significant increase in spending: roughly speaking 3.5 percent of GDP, while something around 1.5 percent will go to security infrastructure, against current 2-3 percent for most of European countries.

The EU strategy to boost Defence through the Readiness 2030 programme has launched a number of measures including the SAFE (Security Action for Europe – SAFE Regulation) plan to provide funding to member states with a very long and low interest loan, almost equal to zero.” After talking to the main shareholder, the Minister of Finance, Cingolani said available funding could reach around € 18 billions for defence and security over the next three-four years. “The Italian Government has the ambition to add € 4 billion per year until 2030, enabling the country to approach 3.0 percent over the next decade only for defence expenditures, to which the infrastructures spending will be added. We could estimate that for every point of GDP increasing in investments for Defence, Leonardo is going to intercept something like € 2-2.5 billions, roughly speaking.” The company expects an organic growth of € 4.8 billion over the € 17.8 billion revenues for 2024, alongside new initiatives for € 1.4 billion, with an expectation by the end of the budget plan in 2029 around € 24 billion. “If we count the new funding coming from national and European institutions and the drive of the NATO request, very likely, with a conservative estimate we can expect that by the end of our budget plan, we could add at least another 4-6 billion in revenues.”

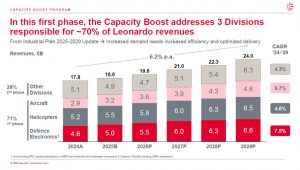

“Are we ready to go in five years from € 17-18 billion revenues to something like almost € 30 billion? Are we efficient enough to deliver with such an exponential growth in demand and of course resources? That’s why we decided to develop the Capacity Boost Programme.” In the first phase it will focus on the three divisions that are making themselves almost 70% of the Leonardo revenues: aircraft, helicopters, and defence electronics. “By the end of the budget plan, we forecast an important growth for each division: 7.5% for electronics, 4.6% for helicopters, and 9.7% for aircraft.

How to keep up with this increasing pace, which corresponds to an average 6.2% per year, in a market that normally grows slower? We created a core team of seven people with experience from different industries, not only defence, which will be permanently operating in the company over the next five years at least to coordinate the Capacity Boost programme. We sided it with 75 people from the three divisions, 25 from each one, taking care of the engineering, manufacturing, procurement, supply chain, human resources issues, and of course project management, alongside a corporate support team dealing with global solutions and logistics. They are working towards the shared objective of increasing capacity and efficiency, with more than 10 key functions engaged to create a cohesive execution, having analysed more than 15 production sites to extract operational insights and opportunities, and so far than 200 hours of working sessions have been done to assess needs and identify initiatives.” Leonardo has established a detailed and robust methodology applied to divisions and functions, comparing expected workload/resources needs for the 2025-2029 timeframe with the current capacity, focusing on each division integrated business plan, as well as the requests coming from the new LRMV, LBA Systems, EdgeWing and both national and European Readiness 2030.

Cingolani presented the current status of the reviewing activities, except for the classified activities related to on-going national and European programmes where respectively, where the company is negotiating in terms of capacity boost concerning Army and Missile Defence issues for example, and “we are waiting for more details about the Readiness 2030 programme”, but “we are doing well in both areas”.

Studying the requests and anticipating the responding strategy, “if we were in a very inertial model without making any effort we could forecast that only for the engineering we might need something like 6 to 7.5 millions extra hours (30-40%). We would also need something like additional 1.7 to 2.3 millions hours (10-15%) for manufacturing and at least we should focus on something like 30 to 60 key strategic supplier that are the most important in the broad supply chain that we have to manage continuously. So considering that one working hour would cost 90 or 100 euro you can easily see that this would be one billion investment just to fulfil the needs in terms of working engineering hours.”

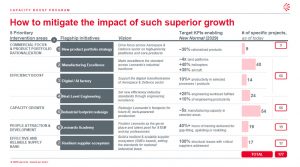

In order to mitigate the impact of such considerable growth and avoid making the same mistakes of the past, Leonardo has identified five priority intervention areas: commercial focus and products portfolio rationalization, efficiency boost, capacity growth, people attraction and development, alongside effective and reliable supply base, declined in seven flagship initiatives. These are a new product portfolio strategy where the company needs to rationalize 30% of it either withdrawing, optimizing, integrating or eventually moving some products to the supply chain where it is more convenient; a 40% and 30% increase in manufacturing efficiency respectively in helicopters and aircraft, alongside four time the same capability in land platforms; support to digital transformation of the aerospace and defence sector with a 10% productivity increase in selected processes and products; new efficiency industry standards through a 25% increment in engineering workload and productivity; an industrial footprint redesign for future-fit, tech-powered production and five time the manufacturing capacity in selected areas, over 40% of training hours delivered for gap-filling, upskilling and reskilling and finally the building of a resilient and scalable supplier ecosystem, setting the standard for national industrial base. “We want to reach these goals thanks to a continuous monitoring and reports every four months, providing achieved numbers on a scheduled base, basically every couple of quarters to the investors,” Cingolani added.

Photos and graphics courtesy Leonardo